A single accident at your kayak fishing tournament could result in millions of dollars in liability claims, equipment damage, and legal fees that could instantly bankrupt your organization – but the right insurance coverage costs less than most tournament entry fees.

Last month, I watched a regional kayak fishing tournament organizer face a $2.3 million lawsuit after a participant suffered severe injuries during launching. The organizer had no insurance coverage, believing their “small local event” didn’t need protection. Three months later, their fishing club dissolved, and the organizer filed personal bankruptcy. This devastating scenario plays out more often than you might think in the kayak fishing community.

As someone who’s organized over 50 kayak fishing tournaments and consulted with insurance providers for the past decade, I’ve seen firsthand how proper insurance transforms potential financial disasters into manageable business expenses. Whether you’re organizing your first club tournament or managing a major championship event, understanding kayak fishing tournament insurance isn’t just smart business – it’s essential survival strategy.

The kayak fishing tournament scene has exploded in recent years, with thousands of events happening nationwide. From local club competitions to major trail championships, tournament organizers face unprecedented liability exposure. Participants expect professional-level safety standards, venues require comprehensive coverage, and state regulations demand compliance with specific insurance requirements.

In this comprehensive guide, I’ll walk you through everything you need to know about protecting your tournament, your participants, and your financial future. We’ll explore real-world coverage scenarios, compare major insurance providers, analyze costs, and provide actionable strategies for different tournament types. By the end, you’ll have a complete roadmap for implementing bulletproof insurance protection that lets you focus on what matters most – creating amazing fishing experiences.

Key Takeaways

- Essential Protection: Kayak fishing tournament insurance is mandatory for most venues and provides crucial liability protection starting around $200-500 per event

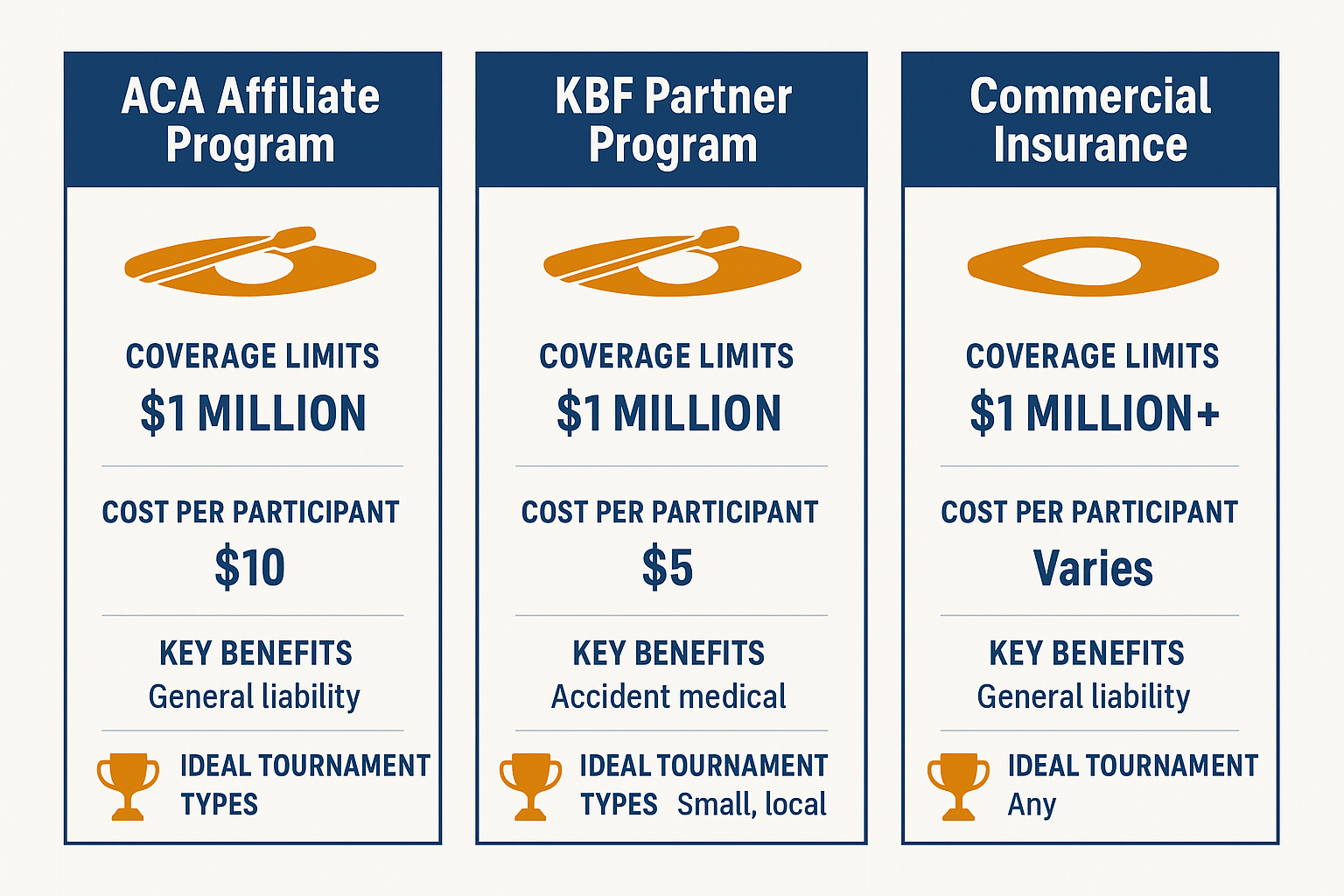

- Multiple Coverage Options: Choose from ACA affiliate programs, KBF partner benefits, or commercial special event insurance based on your tournament type and budget

- Comprehensive Coverage Needed: Beyond basic liability, consider participant accident insurance, equipment protection, and event cancellation coverage

- Cost-Effective Investment: Insurance typically costs $2-8 per participant but protects against million-dollar liability claims and legal expenses

- Legal Compliance: Most venues require $1-2 million in coverage, and proper waivers plus insurance create the strongest legal protection strategy

🎣 Kayak Tournament Insurance Calculator

Why Kayak Tournament Insurance Is Essential

The peaceful image of anglers quietly paddling to their fishing spots belies the significant risks inherent in kayak fishing tournaments. Every event presents multiple liability scenarios that could financially devastate organizers, clubs, and even individual participants. Understanding these risks isn’t about being pessimistic – it’s about being prepared for reality.

Common Kayak Tournament Liability Scenarios

Launching and Loading Incidents represent the highest frequency claims in kayak tournaments. Wet boat ramps, crowded launch areas, and excited participants create perfect conditions for slip-and-fall accidents. I’ve personally witnessed three serious injuries during launches at tournaments I’ve organized, including a participant who suffered a compound fracture after slipping on algae-covered concrete.

On-Water Collisions and Capsizing events can result in severe injuries, especially when participants are focused on fishing rather than navigation. Modern kayak fishing tournaments often involve 50-200 participants in relatively confined areas, creating significant collision risks. Weather changes can quickly turn manageable conditions dangerous, leading to multiple rescue situations.

Equipment-Related Injuries have become increasingly common as kayak fishing gear becomes more sophisticated. Electric motors, sharp fishing tools, and complex rigging systems present injury risks. One tournament I consulted for faced a $180,000 claim when a participant’s improperly secured electric motor caused severe lacerations during a capsize.

Spectator and Volunteer Injuries extend liability beyond participants. Family members helping with weigh-ins, volunteers managing boat ramps, and spectators watching from docks all fall under organizer duty of care responsibilities.

Financial Impact of Uninsured Claims

The financial consequences of uninsured tournament incidents extend far beyond immediate medical costs. Legal Defense Costs alone typically range from $50,000-150,000 even for claims that are ultimately dismissed. Insurance industry data shows the average kayak tournament liability claim settles for $380,000, with severe injury claims reaching $2-5 million.

Venue Liability Exposure creates additional financial risk. Many tournament organizers don’t realize they can be held liable for venue-related injuries even when using public boat ramps or parks. If your tournament participant is injured due to a defective dock or unmarked hazard, you could face joint liability with the property owner.

Business Interruption Costs compound the financial impact. Legal proceedings can freeze club assets, prevent future tournament organization, and destroy relationships with sponsors and venues. I’ve seen three fishing clubs completely dissolve due to uninsured liability claims, losing decades of community building and member investments.

Legal Requirements and Venue Mandates

State Park and Public Venue Requirements vary significantly but typically mandate $1-2 million in general liability coverage. Florida State Parks require $1 million per occurrence, while California demands $2 million for organized events. These requirements aren’t suggestions – they’re legal prerequisites for permit approval.

Private Marina and Resort Insurance Demands often exceed public venue requirements. Premium fishing destinations frequently require $3-5 million in coverage plus additional insured endorsements. Some venues also demand participant accident insurance and property damage coverage for docks and facilities.

Municipal Permit Requirements can include specific insurance provisions, safety protocols, and emergency response plans. Many cities require proof of insurance 30-60 days before events, making last-minute coverage arrangements impossible.

Duty of Care and Negligence Exposure

Tournament organizers assume significant Duty of Care Responsibilities the moment they begin planning events. This legal obligation extends to participant safety, venue selection, weather monitoring, and emergency response planning. Courts have consistently held tournament organizers to professional standards regardless of their volunteer status or non-profit organization structure.

Negligence Claims can arise from seemingly minor oversights. Failing to check weather conditions, inadequate safety briefings, or insufficient emergency planning can all support negligence claims. The legal standard focuses on what a “reasonable tournament organizer” would do, creating professional liability exposure for volunteer organizers.

Vicarious Liability makes organizers potentially responsible for volunteer and staff actions. If a volunteer provides incorrect safety information or fails to properly manage a boat ramp, organizers can face liability for resulting injuries.

Understanding these liability scenarios helps tournament organizers appreciate why insurance isn’t optional – it’s fundamental business protection. The comprehensive guide to kayak fishing emphasizes safety as the foundation of enjoyable fishing experiences, and insurance provides the financial safety net that allows organizers to focus on creating those experiences.

Types of Insurance Coverage for Kayak Tournaments

Navigating insurance coverage options can feel overwhelming, but understanding the five core coverage types helps tournament organizers build comprehensive protection strategies. Each coverage type addresses specific risk scenarios, and the best tournament insurance programs combine multiple coverages for complete protection.

General Liability: The Foundation Coverage

General Liability Insurance forms the cornerstone of tournament protection, covering bodily injury and property damage claims arising from tournament operations. Standard policies provide $1-2 million per occurrence coverage with $2-3 million aggregate limits, protecting against the most common tournament liability scenarios.

Bodily Injury Protection covers medical expenses, lost wages, and pain and suffering damages when participants, spectators, or volunteers are injured during tournament activities. This includes launch area accidents, on-water incidents, and weigh-in injuries. Coverage typically extends from official tournament check-in through final awards ceremonies.

Property Damage Coverage protects against claims for damaged vehicles, boats, docks, or facilities. If a tournament participant’s kayak damages a marina dock or their vehicle causes parking lot damage, general liability coverage responds. This protection is crucial when using private venues with expensive facilities.

Personal and Advertising Injury provisions cover claims related to tournament promotion and communication. If your tournament accidentally uses copyrighted images or makes statements that harm someone’s reputation, this coverage provides legal defense and settlement funding.

Products and Completed Operations coverage extends protection beyond the tournament date, covering claims that arise from tournament activities after the event concludes. This is particularly important for tournaments that provide food, beverages, or promotional products to participants.

Participant Accident and Medical Protection

Participant Accident Insurance provides direct medical coverage for tournament participants regardless of fault or negligence. This coverage fills gaps in participants’ personal health insurance and provides immediate medical expense coverage without lengthy liability investigations.

Primary vs. Excess Coverage distinctions significantly impact claim handling. Primary accident coverage pays medical expenses immediately, while excess coverage only applies after participants exhaust their personal insurance. Primary coverage costs more but provides superior participant protection and reduces organizer liability exposure.

Coverage Limits and Benefits typically range from $10,000-100,000 per participant with options for disability and death benefits. Higher limits cost more but provide better participant protection and demonstrate organizer commitment to safety. Many tournament organizers find $25,000-50,000 limits provide adequate protection at reasonable costs.

Exclusions and Limitations require careful review. Most policies exclude pre-existing medical conditions, injuries from alcohol or drug use, and incidents outside official tournament activities. Understanding these exclusions helps organizers communicate coverage limitations to participants and manage expectations.

Property Damage and Equipment Coverage

Tournament Equipment Protection covers organization-owned property including timing systems, scales, trophies, and promotional materials. This coverage protects against theft, damage, and loss during tournament operations. For tournaments with significant equipment investments, this protection prevents financial losses from replacing expensive items.

Participant Equipment Coverage is rarely included in standard policies but can be added through endorsements. This coverage addresses participant concerns about gear damage during tournaments, though most organizers rely on participant waivers and personal insurance for equipment protection.

Venue Property Protection covers damage to rented or borrowed facilities, boats, and equipment. If tournament operations damage a marina’s dock system or a borrowed boat, this coverage provides repair or replacement funding. Many venues require this coverage as a condition of tournament hosting agreements.

Professional Liability and Instruction Coverage

Professional Liability Insurance protects tournament organizers who provide fishing instruction, guide services, or safety training. This coverage addresses claims that instruction was inadequate, incorrect, or led to participant injuries. Tournament organizers who offer kayak fishing techniques or safety training need this specialized protection.

Errors and Omissions Coverage protects against claims that tournament management errors caused participant losses. If scoring mistakes, rule misinterpretation, or administrative errors cost participants prizes or opportunities, this coverage provides legal defense and settlement funding.

Instruction Liability extends to volunteer guides and experienced anglers who provide informal instruction during tournaments. Even casual advice about kayak fishing gear or techniques can create liability exposure if participants are injured following that guidance.

Event Cancellation and Force Majeure Protection

Weather-Related Cancellation Coverage reimburses organizers for non-recoverable expenses when tournaments are cancelled due to dangerous weather conditions. This includes venue deposits, promotional costs, and staff expenses that cannot be recovered when events are postponed or cancelled for safety reasons.

Venue Unavailability Protection covers situations where contracted venues become unavailable due to damage, closure, or permit revocation. If your tournament venue suffers storm damage or government closure, this coverage helps recover deposits and relocation costs.

Participant Refund Coverage helps organizers provide entry fee refunds when tournaments are cancelled. While not legally required, offering refunds maintains participant goodwill and supports future tournament participation. This coverage makes refunds financially feasible for organizers.

Vendor and Sponsor Contract Protection covers organizer liability when cancellations affect sponsor agreements or vendor contracts. If weather cancellation triggers sponsor refund clauses or vendor penalty fees, this coverage provides financial protection.

Understanding these coverage types helps tournament organizers select appropriate protection for their specific events and risk tolerance. The key is matching coverage to actual tournament risks rather than simply purchasing minimum required limits. Regional kayak fishing tournaments often require different coverage combinations than local club events, making customized insurance essential for proper protection.

Major Insurance Provider Options Compared

2025 Kayak Tournament Insurance Comparison Tool

| Provider | Cost Per Participant | Liability Coverage | Key Features | Best For |

|---|---|---|---|---|

ACA Affiliate Program

Recommended | $3-5 | $1-2 Million | ✓ Easy application process ✓ Established reputation ✓ Quick approval | Small to medium tournaments |

KBF Partnership

Premium | $5-8 | $2-5 Million | ✓ Comprehensive coverage ✓ Tournament circuit benefits ✗ Higher cost | Large competitive events |

Commercial Special Event

Flexible | $2-6 | $1-10 Million | ✓ Customizable coverage ✓ Equipment protection ✗ Complex application | Custom requirements |

| Coverage Type | What’s Covered | Typical Cost | Necessity Level |

|---|---|---|---|

| General Liability | Participant injuries, property damage, legal defense | $200-500 | Essential |

| Participant Accident | Medical expenses for injured participants | $100-300 | Highly Recommended |

| Equipment Protection | Kayaks, gear, and equipment damage/theft | $150-400 | Optional |

| Event Cancellation | Weather, venue issues, emergency cancellations | $200-600 | Optional |

Estimated Insurance Cost

Selecting the right insurance provider requires understanding the unique benefits, limitations, and costs of different coverage sources. Tournament organizers can choose from specialized paddlesport programs, tournament organization partnerships, or commercial special event insurance depending on their specific needs and circumstances.

ACA (American Canoe Association) Insurance Program

The ACA Affiliate Organization Program provides comprehensive general liability coverage specifically designed for paddlesport events and organizations. This program represents one of the most cost-effective options for regular tournament organizers, offering $1 million per occurrence coverage with $3 million aggregate limits.

Membership Requirements and Benefits include annual ACA affiliation fees starting at $150-300 depending on organization size and activities. Affiliate organizations receive automatic general liability coverage for all sanctioned events, eliminating the need for per-event insurance applications. The program also provides access to ACA safety training resources, instructor certification programs, and risk management guidance.

Coverage Scope and Limitations extend to all official organization activities including tournaments, training sessions, and social events. However, coverage excludes commercial operations, instruction for profit, and events with more than 500 participants. The program works best for established clubs hosting regular tournaments rather than one-time event organizers.

Claims Support and Risk Management services include dedicated claims handling through ACA’s insurance partner and access to risk management consultants. The ACA provides template waivers, safety protocols, and emergency response planning resources that help organizations maintain coverage compliance and reduce claim frequency.

Application Process and Timeline requires submission of organization information, activity descriptions, and safety protocols. Approval typically takes 2-3 weeks, making advance planning essential. Once approved, coverage remains active as long as annual membership fees are current and activities remain within approved scope.

Tournament Organization Insurance (KBF, Regional Trails)

Kayak Bass Fishing (KBF) Partner Program provides automatic insurance coverage for official KBF trail tournaments and partner events. KBF Partners receive $1 million per occurrence coverage with no aggregate limit, representing exceptional value for active tournament organizers.

Partnership Requirements and Benefits include annual KBF partnership fees and commitment to hosting minimum numbers of trail tournaments. Partners gain access to KBF’s tournament management system, marketing support, and participant database in addition to insurance coverage. The program works best for organizers planning multiple tournaments annually.

Automatic Coverage vs. Additional Protection means KBF partner insurance covers basic general liability but may not include participant accident insurance, property coverage, or professional liability. Partners hosting high-risk events or using premium venues often need supplemental coverage to meet venue requirements or provide comprehensive participant protection.

Regional Trail Organization Programs offer similar benefits for local and regional tournament circuits. Organizations like state bass fishing associations and regional kayak fishing trails often provide member insurance benefits similar to KBF’s program. These programs typically require membership fees and tournament sanctioning but provide ongoing coverage for multiple events.

Coverage Coordination and Limitations require careful attention to ensure partner organization coverage meets specific venue and regulatory requirements. Some venues require higher limits or additional coverage types not included in standard partner programs, necessitating supplemental commercial coverage.

Commercial Special Event Insurance

Standard Commercial Coverage provides the most flexible and comprehensive protection for tournament organizers who need customized coverage or don’t qualify for specialized programs. Commercial policies typically offer $1-5 million per occurrence limits with $2-10 million aggregate coverage.

One-Time Event vs. Annual Policy Options allow organizers to purchase coverage for single tournaments or annual policies covering multiple events. One-time policies cost $300-800 per event depending on size and risk factors, while annual policies provide better value for organizations hosting multiple tournaments.

Custom Coverage Options and Endorsements enable organizers to add participant accident insurance, equipment coverage, professional liability, and event cancellation protection. This flexibility makes commercial coverage ideal for unique events, high-risk tournaments, or organizers with specific venue requirements.

Provider Comparison and Selection Criteria should focus on paddlesport experience, claims handling reputation, and coverage customization options. Leading providers include:

- Sadler Sports & Recreation Insurance: Specializes in outdoor recreation events with extensive kayak tournament experience

- K&K Insurance: Offers comprehensive special event coverage with strong claims support

- CPH & Associates: Provides customized coverage for sports and recreation organizations

- USLI (Berkshire Hathaway): Offers high-limit coverage for large tournaments and championship events

Cost Factors and Premium Calculations depend on participant numbers, event duration, venue type, coverage limits, and organizer experience. Typical costs range from $2-8 per participant for basic coverage, with comprehensive protection costing $5-15 per participant.

Application Requirements and Timeline vary by provider but typically require event details, participant estimates, venue information, and organizer experience documentation. Most providers need 2-4 weeks for application review and policy issuance, making early planning essential.

Claims Handling and Support Services differ significantly between providers. The best commercial insurers offer 24/7 claims reporting, dedicated claims adjusters with outdoor recreation experience, and risk management consulting services. These support services can be crucial during actual claim situations.

When comparing providers, tournament organizers should consider total cost of coverage, policy flexibility, claims handling reputation, and ongoing support services. The best kayak fishing locations often have specific insurance requirements that influence provider selection, making venue compatibility a key selection factor.

The most successful tournament organizers often combine multiple coverage sources – using ACA or KBF programs for basic protection while adding commercial coverage for enhanced limits or specialized protection. This layered approach provides comprehensive protection while managing costs effectively.

Coverage Requirements by Tournament Type

Different tournament formats present unique risk profiles and insurance needs. Understanding these distinctions helps organizers select appropriate coverage levels while managing costs effectively. The key is matching insurance investment to actual risk exposure and regulatory requirements.

Local Club Tournament Insurance Strategy

Small Local Events (Under 50 Participants) typically require basic general liability coverage to meet venue requirements and provide fundamental protection. These tournaments often use public boat ramps and familiar local waters, reducing some risk factors while maintaining organizer liability exposure.

Cost-Effective Coverage Options for local clubs include ACA affiliate programs or basic commercial special event policies. Annual ACA membership often provides the best value for clubs hosting multiple tournaments, while one-time commercial policies work well for occasional events. Typical costs range from $200-500 per tournament.

Venue Requirements and Compliance for local tournaments usually involve public park permits requiring $1 million general liability coverage. Most local venues accept standard coverage limits, though some popular fishing destinations may require additional insured endorsements or higher limits.

Participant Expectations and Communication for local tournaments focus on basic safety and reasonable protection. Club members typically understand volunteer organization limitations but expect professional safety standards and emergency response planning. Clear communication about coverage limitations helps manage participant expectations.

Risk Management Integration for local tournaments emphasizes prevention over insurance limits. Effective safety briefings, weather monitoring, and emergency response planning reduce claim frequency more than higher coverage limits. Local tournaments benefit from establishing relationships with emergency services and medical facilities.

Regional Trail Tournament Coverage Coordination

Multi-Location Tournament Series require coordinated coverage across different venues and jurisdictions. Regional trails often span multiple states with varying insurance requirements and liability laws. Tournament organizers must ensure coverage meets the highest requirements across all venues.

Trail Organization Partnership Benefits provide significant insurance advantages for regional tournaments. KBF partner programs and regional trail memberships often include automatic coverage that meets most venue requirements. These partnerships also provide standardized safety protocols and risk management resources.

Venue Diversity and Requirements in regional trails range from basic public boat ramps to premium resort facilities. Tournament organizers must verify coverage meets requirements for the most demanding venues in their trail system. Some premium venues require $2-5 million coverage limits and additional insured endorsements.

Participant Travel and Extended Exposure create additional liability considerations for regional tournaments. Participants traveling significant distances have higher expectations for professional organization and comprehensive safety measures. Tournament organizers may face increased liability exposure for providing venue information, lodging recommendations, and travel guidance.

Sponsor and Vendor Coordination requirements often include insurance provisions in sponsorship agreements. Major sponsors may require proof of insurance, additional insured status, or specific coverage limits. These requirements can significantly influence insurance selection and costs.

National Championship and High-Stakes Events

Elevated Risk and Exposure Factors for major tournaments include larger participant numbers, higher-value prizes, media attention, and premium venues. These factors increase both claim frequency and severity potential, requiring enhanced coverage limits and specialized protection.

Enhanced Coverage Requirements for championship events typically include $2-5 million general liability limits, participant accident insurance, professional liability coverage, and event cancellation protection. Some venues or sponsors may require even higher limits or specialized coverage types.

Media and Publicity Liability considerations include personal and advertising injury coverage for tournament promotion, social media activities, and media relations. Championship events with significant publicity need enhanced coverage for potential defamation, copyright infringement, or privacy violation claims.

Prize and Award Protection may require specialized coverage for high-value prizes, especially boats, vehicles, or cash awards. Some tournament organizers purchase separate coverage for prize liability and delivery issues.

Professional Event Management Standards for championship tournaments create higher duty of care obligations and potential professional liability exposure. Courts expect championship events to meet professional standards regardless of organizer volunteer status.

Multi-Day and Destination Tournament Protection

Extended Duration Risk Factors include increased weather exposure, participant fatigue, equipment wear, and logistical complexity. Multi-day tournaments have higher incident rates due to extended exposure and accumulated risk factors.

Lodging and Transportation Coordination may create additional liability exposure if tournament organizers provide recommendations or coordinate group arrangements. While organizers typically aren’t liable for third-party services, providing guidance can create duty of care obligations.

Equipment and Property Extended Exposure requires enhanced property coverage for tournament equipment stored overnight and participant gear protection. Multi-day tournaments often involve significant equipment investments that need protection from theft, weather damage, and loss.

Weather and Cancellation Considerations become critical for multi-day tournaments with significant participant travel and expense investments. Event cancellation coverage helps organizers provide participant refunds and manage sponsor obligations when weather forces cancellations.

Emergency Response and Medical Access planning requires enhanced coordination for multi-day events, especially in remote locations. Tournament organizers need comprehensive emergency response plans and may require specialized medical coverage or evacuation insurance.

Youth and Family Tournament Special Needs

Enhanced Duty of Care for Minors creates significantly higher liability exposure and insurance requirements. Youth tournaments require enhanced safety protocols, supervision standards, and specialized coverage for minor participants.

Parental Consent and Waiver Requirements must meet stricter legal standards for minor participants. Some states don’t recognize parental waivers for minors, requiring enhanced insurance coverage to protect against claims that can’t be waived.

Supervision and Instruction Liability for youth tournaments often requires professional liability coverage for instruction and supervision activities. Tournament organizers providing fishing instruction or safety training to minors face enhanced liability exposure.

Family Event Considerations include spectator safety, child supervision, and family activity coordination. Family tournaments often have higher spectator numbers and more complex logistics requiring enhanced general liability coverage.

Specialized Coverage Requirements for youth tournaments may include enhanced participant accident insurance, specialized supervision liability coverage, and higher general liability limits. Some insurers offer specialized youth sports coverage designed for these unique risks.

Understanding tournament-specific insurance needs helps organizers invest in appropriate protection while avoiding unnecessary coverage costs. The best fishing kayaks for tournaments often influence risk profiles and insurance requirements, making equipment considerations part of comprehensive risk management strategy.

Cost Analysis and Budget Planning

Understanding insurance costs and budget planning helps tournament organizers make informed coverage decisions while managing expenses effectively. Insurance represents a small percentage of total tournament costs but provides essential financial protection that enables sustainable tournament operations.

Premium Calculation Factors and Variables

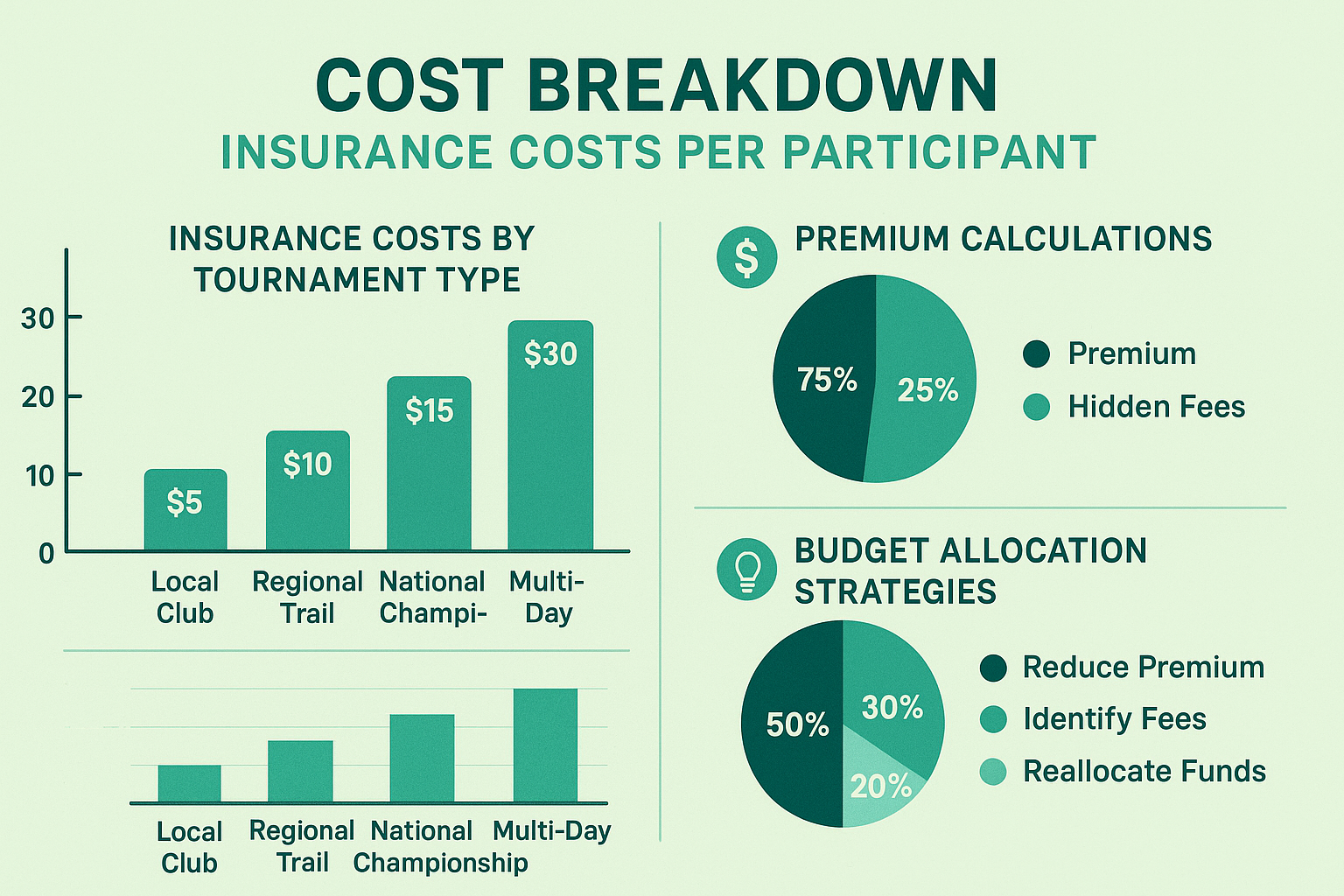

Participant Numbers and Event Size serve as the primary cost drivers for tournament insurance. Most insurers calculate premiums based on participant counts, with typical costs ranging from $2-8 per participant for basic coverage and $5-15 per participant for comprehensive protection.

Tournament Type and Risk Classification significantly impact premium calculations. Local club tournaments receive lower risk ratings than national championships, while multi-day destination tournaments face higher premiums due to extended exposure periods and increased complexity.

Venue Type and Location Risk Factors influence premium calculations based on facility quality, emergency service access, and historical claim frequency. Premium venues with professional facilities typically receive lower risk ratings than remote locations with limited emergency access.

Coverage Limits and Deductible Selection directly impact premium costs. Higher coverage limits increase premiums proportionally, while higher deductibles reduce costs. Most tournament organizers find $1-2 million coverage limits provide optimal protection-to-cost ratios.

Organizer Experience and Claims History affect premium calculations for repeat customers. Experienced organizers with clean claims records often receive premium discounts, while new organizers or those with previous claims face higher rates.

Geographic and Seasonal Risk Factors include regional weather patterns, local emergency services, and seasonal hazard variations. Tournaments in hurricane-prone areas or during severe weather seasons may face premium surcharges.

Cost-Per-Participant Analysis and Budgeting

Basic Coverage Cost Breakdown for typical tournament insurance:

- General liability ($1M): $2-4 per participant

- Participant accident ($25K): $1-3 per participant

- Application and certificate fees: $50-150 per event

- Total basic coverage: $3-7 per participant plus fees

Comprehensive Coverage Investment including enhanced limits and specialized protection:

- General liability ($2M): $3-6 per participant

- Participant accident ($50K): $2-4 per participant

- Professional liability: $1-2 per participant

- Event cancellation: $1-3 per participant

- Total comprehensive coverage: $7-15 per participant plus fees

Cost Allocation Strategies help organizers incorporate insurance costs into tournament budgets:

- Entry Fee Integration: Add insurance costs to participant entry fees ($5-10 per participant)

- Sponsor Coverage: Seek sponsor funding for insurance as safety investment

- Club Subsidization: Use club funds to cover insurance for member events

- Tiered Pricing: Offer basic vs. premium entry options with different coverage levels

Budget Planning Percentages show insurance typically represents 2-5% of total tournament budgets for well-planned events. This small investment provides protection against claims that could exceed total tournament revenues by 10-100 times.

Annual vs. Per-Event Coverage Economics

Annual Policy Advantages for active tournament organizers:

- Cost Savings: 20-40% lower per-event costs for multiple tournaments

- Simplified Administration: Single application and renewal process

- Consistent Coverage: Standardized protection across all events

- Claims Continuity: Established insurer relationships and claims history

Per-Event Policy Benefits for occasional organizers:

- Lower Initial Investment: No annual commitment or unused coverage

- Flexibility: Customize coverage for specific event needs

- Testing Options: Try different insurers and coverage levels

- Seasonal Operations: Avoid paying for coverage during inactive periods

Break-Even Analysis typically shows annual policies become cost-effective for organizers hosting 3-4 tournaments per year. The exact break-even point depends on tournament size, coverage requirements, and insurer pricing structures.

Cash Flow Considerations favor per-event policies for new organizers with limited capital, while established organizations benefit from annual policy predictability and budget planning advantages.

Hidden Costs and Additional Fees

Application and Underwriting Fees range from $50-200 per policy depending on coverage complexity and insurer requirements. These fees apply regardless of coverage limits and represent fixed costs for tournament insurance.

Certificate and Endorsement Fees for additional insured certificates, venue endorsements, and coverage modifications typically cost $25-75 per certificate. Tournaments requiring multiple certificates for different venues or sponsors can accumulate significant certificate fees.

Payment Processing and Installment Fees may apply for premium financing or installment payment plans. Some insurers charge 2-5% fees for credit card payments or monthly payment plans.

Policy Modification and Cancellation Fees can apply when tournament details change after policy issuance. Participant number changes, venue modifications, or coverage adjustments may trigger additional fees.

Claims Deductibles and Self-Insured Retention represent potential out-of-pocket costs when claims occur. Most tournament policies include $500-2,500 deductibles that organizers must pay before insurance coverage applies.

Legal and Professional Service Costs for policy review, risk management consulting, and claims assistance may represent additional expenses for complex tournaments or claim situations.

Risk-Adjusted Return on Insurance Investment

Claim Frequency Analysis shows kayak tournament insurance claims occur in approximately 1-3% of events annually. However, claim severity can range from minor medical expenses ($1,000-5,000) to major liability settlements ($100,000-2,000,000+).

Expected Value Calculations demonstrate positive insurance ROI even with low claim frequency:

- Average annual premium: $2,000-5,000 for active organizer

- Average claim cost when uninsured: $50,000-200,000

- Break-even claim frequency: 1-4% annually

- Actual claim frequency: 2-5% annually including minor incidents

Risk Transfer Value extends beyond direct claim costs to include legal defense expenses, business interruption protection, and peace of mind benefits. These intangible benefits often justify insurance costs even when direct claims don’t occur.

Tournament Sustainability Impact shows insured tournaments have significantly higher long-term success rates than uninsured events. Insurance enables organizers to focus on tournament quality rather than liability concerns, improving participant satisfaction and repeat attendance.

Competitive Advantage Considerations include participant attraction benefits from demonstrating professional risk management and comprehensive safety measures. Many experienced tournament anglers prefer events with proper insurance coverage, viewing it as a quality indicator.

Understanding insurance economics helps organizers make informed coverage decisions that balance protection needs with budget constraints. The comprehensive kayak fishing guide emphasizes that proper planning and risk management, including insurance, form the foundation of successful tournament operations.

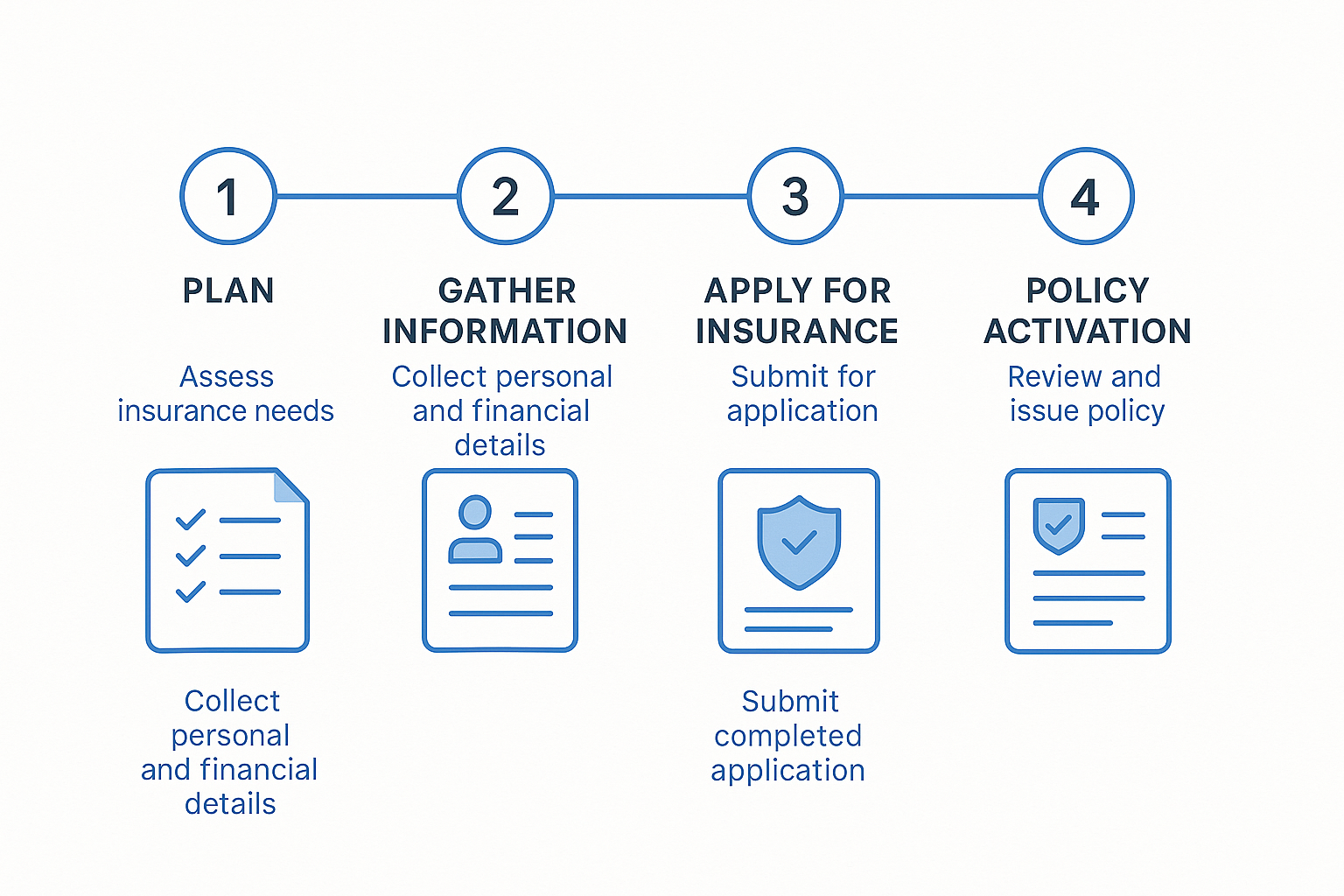

Application Process and Requirements

Successfully obtaining tournament insurance requires understanding application procedures, documentation requirements, and timeline planning. Different insurance providers have varying requirements, but following systematic application approaches ensures smooth approval processes and timely coverage activation.

Application Documentation and Requirements

Basic Organizational Information forms the foundation of all insurance applications. Insurers require legal organization names, addresses, contact information, and organizational structure details. Non-profit organizations need tax-exempt status documentation, while for-profit entities require business registration information.

Tournament Details and Specifications must include comprehensive event descriptions covering participant numbers, tournament format, venue locations, and activity scope. Insurers need specific information about fishing methods, kayak types, safety equipment requirements, and tournament rules to assess risk accurately.

Venue Information and Contracts require detailed documentation of tournament locations including facility types, emergency service access, and existing safety features. Many insurers request venue contracts or permit applications to verify insurance requirements and additional insured obligations.

Safety Protocols and Risk Management Documentation demonstrate organizer commitment to loss prevention. Effective applications include written safety procedures, emergency response plans, participant screening requirements, and equipment standards. Kayak fishing safety protocols should be clearly documented and consistently implemented.

Previous Insurance and Claims History must be disclosed accurately and completely. Insurers review past coverage, claims frequency, and loss experience to assess risk. New organizers without previous insurance history aren’t penalized, but experienced organizers with good records often receive premium discounts.

Financial Information and Organizational Capacity may be required for large tournaments or high-limit coverage. Some insurers request financial statements, budget projections, or organizational capacity documentation to verify ability to manage significant events safely.

Timeline Planning and Advance Preparation

Application Submission Timeline should begin 60-90 days before tournament dates for complex events or new organizers. Simple renewals or standard coverage may only require 30-45 days, but advance planning prevents last-minute coverage issues.

Underwriting and Review Periods typically require 2-4 weeks for application review and approval. Complex tournaments, new organizers, or high-risk events may require additional underwriting time. Some insurers offer expedited processing for additional fees.

Policy Issuance and Certificate Generation usually occurs 1-2 weeks after approval. Venue requirements often specify certificate delivery timelines, making early application submission essential for meeting permit deadlines.

Venue Notification and Compliance Verification should occur immediately after policy issuance. Many venues require certificate review and approval before finalizing tournament permits, adding additional timeline requirements.

Participant Communication and Registration Integration helps tournament organizers communicate insurance protection to participants during registration. This transparency builds participant confidence and demonstrates professional risk management.

Contingency Planning and Backup Coverage options should be identified during application processes. Having backup insurers or alternative coverage sources prevents tournament cancellation if primary applications are delayed or denied.

Common Mistakes and Approval Pitfalls

Incomplete or Inaccurate Information represents the most common application delay cause. Missing venue details, incorrect participant estimates, or incomplete safety documentation can delay approval for weeks while insurers request additional information.

Underestimating Participant Numbers creates coverage gaps and potential claim denial issues. Insurers base premiums and coverage on declared participant numbers, and significant underestimation can void coverage. Always estimate conservatively and purchase coverage for maximum expected attendance.

Inadequate Safety Documentation concerns insurers who need evidence of proper risk management. Applications without written safety procedures, emergency response plans, or equipment requirements face higher premiums or coverage denial.

Last-Minute Application Submission prevents proper underwriting review and creates unnecessary stress. Rush applications often receive higher premiums or reduced coverage options compared to advance submissions.

Venue Requirement Misunderstanding leads to coverage gaps when insurance doesn’t meet specific venue mandates. Always obtain venue insurance requirements before applying for coverage to ensure policy compliance.

Claims History Disclosure Issues can result in coverage denial or policy cancellation. Failing to disclose previous claims or incidents, even if no insurance was involved, violates application honesty requirements and can void coverage.

Policy Activation and Certificate Management

Policy Effective Dates and Coverage Timing should align with tournament setup and breakdown periods. Coverage should begin before equipment setup and extend through final cleanup to ensure complete protection.

Certificate of Insurance Generation requires specific venue and additional insured information. Certificates must accurately reflect policy terms, coverage limits, and additional insured status to satisfy venue requirements.

Additional Insured Endorsements may be required for venues, sponsors, or partner organizations. These endorsements extend policy coverage to specified parties and must be properly documented and certificated.

Policy Document Review and Distribution ensures all stakeholders understand coverage terms, limitations, and claim procedures. Tournament organizers should review policies carefully and distribute relevant information to key staff and volunteers.

Coverage Verification and Compliance Confirmation with venue requirements prevents last-minute coverage issues. Many venues require certificate review and approval before finalizing tournament permits.

Claims Reporting Procedures and Contact Information should be readily available to tournament staff and volunteers. Immediate claim reporting is crucial for proper coverage, making contact information and procedures essential tournament planning elements.

Policy Modification and Change Procedures allow organizers to adjust coverage for participant number changes, venue modifications, or scope adjustments. Understanding modification procedures prevents coverage gaps when tournament details change.

Successful insurance applications require attention to detail, advance planning, and thorough documentation. The best kayak fishing tournaments demonstrate professional organization and comprehensive risk management, with proper insurance coverage serving as a foundation element of tournament success.

Claims Process and Risk Management

Understanding claims procedures and implementing effective risk management strategies helps tournament organizers minimize incidents while ensuring proper claim handling when accidents occur. The combination of prevention and preparation creates the most effective tournament protection strategy.

Incident Documentation and Reporting Protocols

Immediate Response Procedures require systematic incident documentation beginning at the scene. Tournament staff should photograph accident locations, equipment involved, and environmental conditions while ensuring injured parties receive appropriate medical attention. Proper kayak fishing safety equipment can prevent many incidents, but thorough documentation is essential when accidents occur.

Witness Information and Statement Collection should begin immediately while memories remain clear and witnesses are available. Collect contact information, written statements, and any photos or videos witnesses may have captured. Multiple witness perspectives often provide crucial information for claim resolution.

Medical Documentation and Treatment Records must be carefully tracked from initial treatment through final resolution. Maintain copies of emergency medical reports, hospital records, and follow-up treatment documentation. This information is essential for both insurance claims and potential legal proceedings.

Equipment and Property Damage Assessment requires detailed documentation of all damaged items including photographs, serial numbers, and estimated replacement costs. For kayak damage, document the specific kayak model and modifications that may affect replacement costs.

Environmental and Condition Documentation should include weather conditions, water levels, facility conditions, and any unusual circumstances that may have contributed to incidents. This information helps insurers understand claim circumstances and may identify preventable risk factors.

Internal Incident Reports provide comprehensive documentation for organizational learning and insurance purposes. Effective reports include timeline reconstruction, contributing factor analysis, and recommendations for future prevention.

Claims Filing Process and Timeline Management

Initial Claim Notification must occur within 24-48 hours of incident discovery according to most insurance policies. Late notification can jeopardize coverage, making immediate insurer contact essential even for minor incidents that may develop into significant claims.

Claim Number Assignment and Adjuster Contact typically occurs within 24 hours of initial notification. Insurers assign dedicated claim adjusters who serve as primary contacts throughout the claim process. Maintain regular communication with adjusters and respond promptly to information requests.

Documentation Submission and Evidence Preservation requires organized presentation of all incident-related information. Submit photographs, witness statements, medical records, and incident reports in organized formats that help adjusters understand claim circumstances quickly.

Investigation Cooperation and Information Access obligations require tournament organizers to provide complete access to claim-related information and personnel. Cooperation includes making witnesses available, providing additional documentation, and assisting with incident reconstruction efforts.

Settlement Negotiation and Resolution processes vary significantly based on claim complexity and severity. Minor medical claims may resolve within weeks, while major liability claims can require months or years for final resolution. Maintain realistic expectations and regular communication with adjusters throughout the process.

Claim Closure and Documentation provides final resolution documentation that’s important for future insurance applications and organizational records. Retain complete claim files including final settlement documentation and lessons learned analysis.

Preventive Risk Management Strategies

Comprehensive Safety Briefings serve as the first line of defense against tournament incidents. Effective briefings cover launching procedures, on-water safety, emergency signals, and equipment requirements. Document briefing attendance and content to demonstrate duty of care compliance.

Venue Inspection and Hazard Identification should occur before every tournament to identify and address potential safety issues. Check boat ramp conditions, dock stability, parking area hazards, and emergency access routes. Document inspections and corrective actions taken.

Weather Monitoring and Decision Protocols require systematic weather tracking and clear decision-making criteria for tournament modifications or cancellations. Establish specific wind, lightning, and severe weather thresholds that trigger safety protocols.

Equipment Standards and Inspection Requirements help ensure participant safety and reduce equipment-related incidents. Establish minimum safety equipment requirements and consider implementing inspection procedures for fishing kayaks and safety gear.

Emergency Response Planning and Coordination with local emergency services improves incident response and demonstrates professional organization. Establish relationships with marine patrol, emergency medical services, and search and rescue organizations in tournament areas.

Participant Screening and Communication helps identify high-risk participants and ensures appropriate safety awareness. Consider experience requirements for challenging tournaments and maintain clear communication about tournament risks and safety expectations.

Safety Protocols and Participant Screening

Experience Level Assessment helps match participants with appropriate tournament challenges. Consider implementing experience requirements or skill assessments for tournaments in challenging fishing locations or adverse conditions.

Medical Information and Emergency Contacts collection provides essential information for emergency response. Maintain confidential medical information and emergency contact databases accessible to tournament staff during events.

Safety Equipment Verification ensures participants have appropriate protective gear and emergency equipment. Consider mandatory equipment lists including personal flotation devices, communication devices, and emergency signaling equipment.

Buddy System and Check-In Procedures provide additional safety monitoring for participants during tournaments. Regular check-ins and buddy system protocols help identify problems before they become emergencies.

Communication Systems and Emergency Procedures must be clearly established and communicated to all participants. Ensure tournament staff have reliable communication methods and participants understand emergency signal procedures.

Post-Tournament Follow-Up helps identify incidents that may not be immediately apparent and demonstrates ongoing concern for participant welfare. Follow-up communication also provides opportunities to gather feedback for safety improvement.

Post-Incident Liability Mitigation

Communication Management and Public Relations require careful coordination to avoid statements that could increase liability exposure. Limit public statements to factual information and direct media inquiries to insurance representatives or legal counsel.

Social Media and Documentation Control helps prevent inadvertent liability admissions or privacy violations. Train staff and volunteers about appropriate social media conduct following incidents and monitor online discussions about tournament safety.

Participant and Family Communication should be compassionate while avoiding liability admissions or settlement discussions. Express concern for injured parties while directing specific questions to insurance representatives.

Vendor and Sponsor Coordination may be necessary if incidents affect partnership agreements or create additional liability exposure. Notify relevant partners about incidents that may affect their interests or obligations.

Legal Counsel Coordination becomes necessary for serious incidents or potential litigation. Insurance policies typically provide legal defense, but early coordination helps ensure proper claim handling and liability protection.

Organizational Learning and Improvement transforms incident experience into improved safety protocols and risk management. Conduct thorough post-incident analysis and implement improvements to prevent similar future incidents.

Effective claims management and risk prevention work together to create comprehensive tournament protection. The most successful tournament organizers combine proper insurance coverage with proactive safety management to create sustainable, safe tournament operations that participants trust and enjoy.

Legal Considerations and Compliance

Understanding legal requirements and compliance obligations helps tournament organizers navigate complex liability landscapes while maintaining proper protection. Legal considerations extend beyond insurance to include waivers, state law variations, and contractual obligations that significantly impact organizer liability exposure.

Waiver and Release Legal Requirements

Waiver Enforceability and State Law Variations create complex legal landscapes for tournament organizers. Some states strongly enforce properly written waivers, while others limit waiver effectiveness or prohibit certain liability releases. Understanding your state’s waiver laws is essential for proper risk management strategy.

Essential Waiver Elements and Language must include specific components to maximize enforceability. Effective waivers clearly identify released parties, describe covered activities and risks, use understandable language, and include assumption of risk provisions. Generic waivers downloaded from the internet often lack state-specific requirements that could void their protection.

Minor Participant Waiver Limitations present significant challenges since many states don’t allow parents to waive their children’s rights to sue for negligence. Youth tournaments require enhanced insurance coverage and safety protocols to compensate for limited waiver protection.

Waiver Administration and Documentation procedures must ensure all participants sign appropriate releases before tournament participation. Maintain organized waiver files with legible signatures and proper witness documentation. Electronic waivers are increasingly accepted but must meet specific technical and legal requirements.

Waiver Language Customization should address specific tournament risks and activities. Generic language may not cover unique aspects of kayak fishing tournaments or specialized equipment use, requiring customized waiver provisions for complete protection.

Legal Review and Updates ensure waivers remain current with changing state laws and court decisions. Annual legal review helps identify necessary updates and maintains maximum waiver effectiveness.

State Law Variations and Compliance Issues

Liability Law Differences between states significantly impact tournament organizer exposure and insurance requirements. Some states follow comparative negligence rules that reduce organizer liability, while others apply strict liability standards that increase exposure.

Insurance Requirement Variations differ significantly between states and local jurisdictions. Some states mandate specific coverage types or limits for organized events, while others rely on venue requirements or voluntary compliance.

Professional Licensing and Certification Requirements may apply to tournament organizers who provide instruction or guide services. States with outfitter licensing requirements may mandate specific insurance coverage or professional qualifications for tournament guides.

Youth Protection and Supervision Laws create enhanced obligations for tournaments involving minor participants. Some states require background checks, specialized training, or enhanced supervision ratios for youth activities.

Environmental and Natural Resource Regulations may impact tournament operations and insurance requirements. Tournaments in protected waters or sensitive environmental areas may face additional compliance obligations and liability exposure.

Business Registration and Tax Obligations can affect insurance requirements and liability exposure. Tournament organizers operating across state lines may need multiple business registrations and varying insurance coverage.

Venue Contracts and Additional Insured Requirements

Standard Venue Insurance Clauses typically require general liability coverage ranging from $1-5 million with additional insured endorsements for venue owners. Understanding these requirements before signing contracts prevents coverage gaps and compliance issues.

Additional Insured Endorsement Types vary in scope and protection level. “Primary and non-contributory” endorsements provide the strongest venue protection, while standard additional insured coverage may leave venues with residual exposure.

Indemnification Clause Analysis requires careful legal review since these provisions can create unlimited liability exposure beyond insurance coverage limits. Some indemnification clauses are unenforceable, while others create significant financial risk.

Certificate of Insurance Requirements must be met exactly as specified in venue contracts. Incorrect certificates can void venue agreements and create last-minute tournament cancellation risks.

Venue Liability and Shared Responsibility issues arise when both organizers and venues contribute to participant injuries. Understanding shared liability concepts helps organizers negotiate appropriate contract terms and insurance coverage.

Contract Modification and Insurance Coordination may be necessary when standard venue requirements exceed available insurance coverage or create unreasonable cost burdens. Experienced insurance brokers can often negotiate modified requirements that protect venues while maintaining reasonable organizer costs.

Participant Disclosure and Notification Obligations

Risk Disclosure Requirements mandate clear communication about tournament hazards and participant responsibilities. Effective disclosure goes beyond waivers to include comprehensive risk communication during registration and safety briefings.

Medical Condition and Emergency Information collection must balance safety needs with privacy requirements. Tournament organizers need sufficient medical information for emergency response while complying with health information privacy laws.

Insurance Coverage Communication helps participants understand what protection is provided and what gaps may exist in their personal coverage. Clear communication about participant accident insurance limits and exclusions prevents misunderstandings about coverage scope.

Safety Protocol and Equipment Requirements must be clearly communicated during registration and reinforced during safety briefings. Participants need complete information about required safety equipment and emergency procedures.

Tournament Rule and Penalty Disclosure should include safety-related rules and consequences for non-compliance. Clear rule communication helps prevent incidents and provides documentation for disciplinary actions.

Emergency Contact and Medical Authorization procedures must be established for all participants, especially minors. Proper authorization forms enable emergency medical treatment when participants can’t consent for themselves.

Record Keeping and Documentation Obligations

Insurance Policy and Certificate Maintenance requires organized filing systems that provide quick access to coverage documentation. Many venue contracts specify insurance documentation retention periods and access requirements.

Waiver and Release Documentation must be maintained according to state statute of limitations periods, typically 2-6 years. Organized waiver filing systems enable quick retrieval for claim defense or legal proceedings.

Incident and Accident Records should be maintained permanently since some claims may not emerge for years after incidents occur. Comprehensive incident documentation often proves crucial for successful claim defense.

Participant Registration and Medical Information requires secure storage with appropriate privacy protections. Medical information must be protected according to health privacy laws while remaining accessible for emergency response.

Safety Training and Certification Documentation demonstrates organizer commitment to professional standards and duty of care compliance. Maintain records of staff training, certification updates, and safety protocol implementation.

Financial and Operational Records may be relevant to insurance claims or legal proceedings. Maintain organized records of tournament budgets, vendor contracts, and operational procedures that demonstrate professional management.

Communication and Correspondence Files including emails, letters, and social media interactions may become relevant to claim investigations or legal proceedings. Maintain organized communication files while being mindful of privileged or confidential information.

Understanding legal compliance requirements helps tournament organizers build comprehensive protection strategies that combine insurance coverage with proper legal documentation and procedures. The best tournament operations demonstrate professional legal compliance that protects organizers, participants, and venues while creating positive tournament experiences.

🧮 Tournament Insurance Cost Calculator

📅 Tournament Insurance Planning Timeline

- Research insurance providers and coverage options

- Determine venue requirements and liability limits

- Estimate participant numbers and event scope

- Contact ACA affiliate programs for membership benefits

- Submit insurance applications to multiple providers

- Compare quotes and coverage details

- Review policy terms and exclusions carefully

- Negotiate coverage limits and deductibles

- Purchase selected insurance policy

- Obtain certificates of insurance for venues

- Prepare participant waivers and safety protocols

- Distribute insurance information to stakeholders

- Confirm insurance coverage is active

- Review emergency contact procedures

- Brief staff on incident reporting protocols

- Ensure all permits and documentation are complete

❓ Frequently Asked Questions

Conclusion

Protecting your kayak fishing tournament with proper insurance coverage isn’t just a smart business decision – it’s an essential investment in your event’s sustainability and your financial security. Throughout this comprehensive guide, we’ve explored the critical importance of tournament insurance, analyzed coverage options, compared providers, and outlined implementation strategies that transform potential financial disasters into manageable business expenses.

The kayak fishing tournament landscape has evolved dramatically, with increased participation, higher expectations, and greater liability exposure creating unprecedented risks for organizers. A single serious incident can generate millions in liability claims, legal expenses, and business interruption costs that could instantly bankrupt unprepared organizers. However, comprehensive insurance coverage costing just $2-8 per participant provides robust protection against these catastrophic scenarios.

Your next steps should include immediate action on three critical fronts:

First, assess your current risk exposure by conducting honest evaluation of your tournament operations, venue requirements, and potential liability scenarios. Review existing coverage gaps and identify specific insurance needs based on your tournament type, participant numbers, and operational scope. Use the interactive calculator provided in this guide to estimate appropriate coverage costs and compare provider options.

Second, begin the application process immediately for your next tournament or upcoming season. Don’t wait until last-minute permit deadlines create unnecessary pressure and limit coverage options. Contact ACA affiliate programs, KBF partnership opportunities, or commercial insurers to begin application processes at least 60-90 days before your events.

Third, integrate comprehensive risk management with your insurance strategy by implementing proper safety protocols, emergency response planning, and participant communication systems. Insurance provides financial protection, but prevention remains the most effective risk management strategy.

The tournament organizers who thrive in today’s environment combine professional insurance coverage with systematic safety management and clear legal compliance. They understand that insurance costs represent tiny investments compared to the financial protection provided, and they view comprehensive coverage as competitive advantages that attract quality participants and sponsors.

Your tournament participants trust you with their safety and expect professional-level risk management. Proper insurance coverage demonstrates that commitment while protecting your personal assets, organizational sustainability, and community relationships. The fishing community depends on dedicated organizers like you to create safe, enjoyable tournament experiences – and proper insurance coverage provides the foundation that makes those experiences possible.

Don’t let inadequate insurance coverage threaten everything you’ve built in the kayak fishing community. Take action today to implement comprehensive protection that lets you focus on what you do best – creating amazing fishing experiences that bring our community together on the water.